The lifestyle bank that moves you forward!

Personal Banking. Business Banking. Payment Gateway

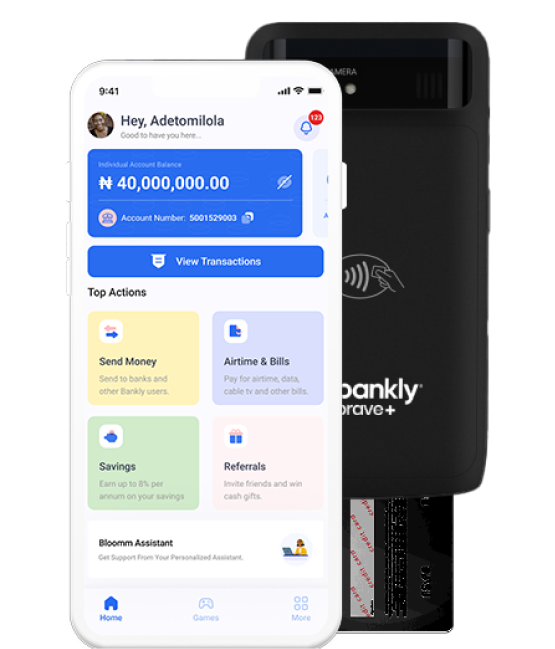

Move forward with personal banking

Manage your money, pay your bills, send money to friends and family all from one place.

Move forward with a business account

Open a business account in your business name. Request for a POS terminal to accept payments in-store or on-the-go. Our POS terminals offer more options and help keep your queues short.

Move forward with our APIs

Plug into our bouquet of API products that enables businesses to unlock seamless payment experiences and drive growth.

Business

Start your journey to business success.

Open a business account in your business name in just 3 minutes. You can request for a POS terminal to cut transaction time in half, making the most of every minute. Say goodbye to slow payments with our advanced POS terminals.

PERSONAL

Stay ahead with banking that enables your lifestyle.

- Get 2% Cashback on every bill payment.

- Earn 12% annual interest on savings.

- Experience fast transfers with 99% success rate.

- Save and stand a chance to win N10,000 daily.

- Earn up to N100,000 monthly from our attractive referral program.

- Do more together. Achieve goals with friends and families using the group savings feature.

CORPORATE

Collect payments on your website and mobile app.

Our end-to-end Banking as a Service model enables third parties to connect with Bankly’s infrastructure directly via APIs, thereby enabling you to keep moving forward with a payment solution that is fast, secure and user-friendly.

TESTIMONIALS

What everybody is saying about us

Rita Oboh

First time I will come across this app. It was so easy to generate Account and the features so inviting. I explored most of the features and the part that interested me most is the game part. Can you imagine having fun, but at the same time you are been disciplined with savings. Great app!

Segun Oluwalana

The onboarding process is seamless, I registered in less than 3 minutes. I also like the user interface looked very modern. Then the 12% return on savings is very good compared to other saving platforms. Then the jackpot experience where you can win as high as one million naira every day. I absolutely love it.

Edidiong Isaac (Lolly)

I love the app cos of the low transaction charges, you can monitor and track your transactions, cool cash back and also easy to navigate. I recommend it for those that wish to save their money too.

Austin

It's a very nice app woth user friendly UI. Registration is so easy, just follow the steps correctly and you're good to go. Winning the jackpot steadily can take you out of trenches 😋

Abiodun A. Ayinla

Love the app. I registered in less than 3 minutes. I also like the user interface looked very modern. Then the 12% return on savings is very good compared to other saving platforms. Also the jackpot experience where you can win as high as one million naira every day. I absolutely love it.

UDEH SAMUEL OBINNA

The interface is very modernized and friendly, the financial transactions are always successful without problems. Are you looking for the best app for transfers, saving and other online financial activities? Then this is the best app to use, how i wish I can give it 20 stars!

Joy Philip

The app is accessible and easy to operate on. I personally love the bonus aspect. Making peer to peer transfer easy and reliable. The games aspect is equally great 👍

Joseph Ocheme

I love the User interface, security and how it requires the necessary verification before usage. Most of all, it's very fast during transactions.

Olamide Oyinloye

I haven't used this app for transactions but the registration and everything was fast and no ads showing on this app. I encourage people to download and start making use of this app. I will definitely use it because I'm a mobile money business person and I'm always looking for a better way to help my customers because my customers always looking for an opportunity to get an economical way of transacting. Good Appearance and assistant answered me immediately I sent a message to them, very fast.

Samuel Etim

Awesome app, a seamless approach to savings. Money transfer, bill payment and savings at a click-of a button. I particularly enjoy the decent interest offered on savings. Great app

Maranatha (Daizel)

Great app. It has a simple, nice and user friendly layout. I most like it's auto saving feature which makes it easier and stress free for me to save even when I forget.

Products

How our product works

Blog

Coin Chronicles

-1.jpg)

How to plan for a group trip using a Group Contributions (Ajo) app

How do you make your dream trips with friends a reality? We’re glad you asked. In this article, we share the not-so-secret ingredients to planning successful group trips with friends.

Admin

(1).jpg)

Savings vs Investments: How to Grow Your Money with a Savings Account

How a savings account can help you to grow your money gradually, while you enjoy financial security and accessibility.

Admin

.jpg)

Top 5 small business ideas to start with ₦100k in Nigeria - 2024

In this article, we have compiled a detailed list of the best businesses to start with less than ₦100k in Nigeria. So, if you're ready to turn that ₦100k into ₦1 million in one year, keep reading.